While it's great that you have insurance, did you know that you need to have an itemized list of your belongings in order to get the payout from your insurance company? You may be able to list a number of the things you own, but would you be able to name everything? Would you have the information you need about antiques, value of jewelry, or custom pieces?

Home inventories are a great way to itemize all your belongings so that in the event of a disaster, you can get back the maximum amount for your valuables and be able to reclaim your life. The other upside of an inventory is that it may highlight that you are currently under-insured.

Take Photos And Video

Plan to spend a good chunk of a day to video record your belongings and itemize your belongings. Go room by room and be thorough. Zoom in on brand names and serial numbers. Add these to your list along with estimated value and a receipt if you have one. Use a spreadsheet to keep everything clear and concise. Or use Evernote, One Note or Google Docs for easy document storage and retrieval from anywhere. Be sure to keep a copy of your itemized list on a jump drive or external hard drive. And keep that in a fireproof location at your home or at a secure off-site location.

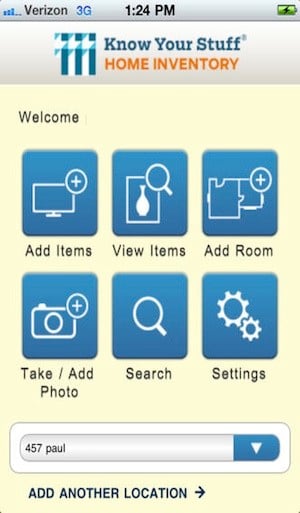

There's An App For That

To make things even simpler, you can find an app for your tablet of phone that will do much of the work for you. Many insurance companies my already have an app that you can use. Check with them first since their app will likely include any requirements specific to their company. "Know Your Stuff" is a free online inventory service provided by the Insurance Information Institute.

Keep It Up To Date

A home inventory is great as long as it reflects your current possessions. If you last did an inventory five or more years ago, it's probably time to update it. Review you list and determine where you need updates. Then plan to review and update your list every few years.

Source: Michelle Schwake for Stafford Family Realtors

No comments:

Post a Comment