Let's face it, once the framing of your house is up, it's hard to make major changes, like moving a staircase, without it doing serious damage to your budget. Therefore, it's essential to plan out every room carefully to make sure you have it right. When we built our last home we wanted a main floor laundry room. Everything looked fine on the plans but when we moved in we realized that the room was way too small given that we had a front loading washer and dryer. Once the floor was piled with clothes you could barely move in there. We really wish we had taped out the dimensions of that room to make sure it made sense.

Save yourself frustration after moving in by takeing some ideas from the list we've compiled. And feel free to comment and add some yourself!

Design & Build

1. If you plan on staying in your home throughout your retirement, plan in universal design elements like a main floor master bedroom with en suite, no-clearance showers, and wheelchair accessible elements where ever you won't be able to make changes after the house is built.

2. If you can't imaging sleeping on the main floor then plan space for an elevator shaft that can be incorporated at a later date. You can use the space as a storage closet in the meantime.

3. If you plan to house a water softener in your basement, install a staircase from the garage to the basement for hauling salt without tracking everything through the house.

4. If you plan on having a home-based business, plan your space so that there is easy access to the outside for customers/clients.

5. If you have a growing family, allow more space for a mudroom with a bathroom very close by.

6. Plan a multi-purpose room between the kitchen and garage that includes space for a family desk , charging station/purse storage, printer/modem/router storage, paper recycling for mail with a nearby shredder, lockers, chest freezer, pet feeding/cleaning/litter box station, pantry for bulk storage (think paper towels/toilet paper/cases of soda), and possibly laundry or at least access to the laundry room. Top it off with a pocket door. These are all functions that tend to be on the messy side so you can keep them out of site by just closing the door. And the bonus is that finishes in this area can be scaled down to save money since its an area off-limits to the larger public.

7. Plan your house siting and window placement to take advantage of the sun and block north winds in the winter.

8. If you plan on building without a basement, be sure to include space for a reinforced storm shelter somewhere within your home or close enough to your home that you can get there in a matter of seconds.

9. If you have a lot of art that you like to display, make sure you plan in wall space. Many open-concept floor plans have very little wall space because there are very few inner walls and all the outer walls are covered in windows.

10. Be sure you size your rooms correctly, especially if they are smaller rooms (like laundry rooms) or if it will occupy many people at one time (like the kitchen). Go to a large space or outside and lay out the space with tape or rope, including appliances and furniture. Then walk the space as you would use it to help determine if the size is appropriate.

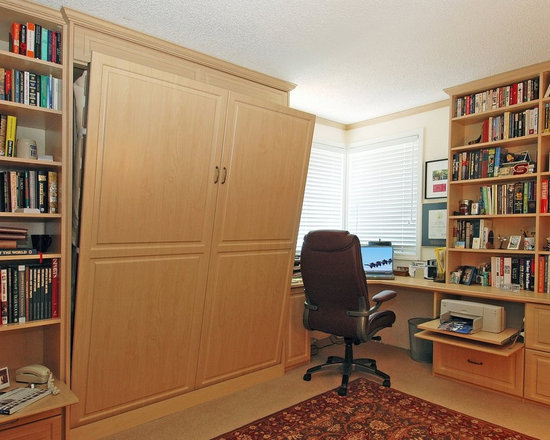

11. Since you are custom building your home, include special touches that make it your own like window seats, custom niches for special furniture or art, columns, and built-ins.

12. Don't let the builders box off every space but use it for storage or bookshelves. Knee walls that partition a dining room from a living room, the dividing wall near the toilet, etc.

13. Reconsider "formal" spaces. If you are a family that rarely entertains, why have a formal living room and dining room? Instead opt for nicer finishes in your breakfast nook or great room so that it can function as a formal entertaining space when needed. Bonus, you'll save money with less need for extra furniture.

14. Be sure your access to outdoor decks and patios makes sense. A door near the kitchen makes sense for those who grill a lot and enjoy eating outdoors.

15. Plan in an away space, especially if you have children. This space should be close to the main activity centers of the house but have a door to enclose it, possibly even a glass door so that you feel connected but still separate. You can plan it for a place to send the kids or a place for you to go when things get too hectic but you can still keep an eye on things.

16. Carefully consider the placement and size of your windows. You can always downsize a window at a later date but it's much harder to make a window larger.

17. Have your builder reinforce the top side of windows, extending beyond each side of the window to accommodate heavy curtains and rods.

18. If you plan on having curtains, make sure the builder doesn't place heating/cooling vents on the edges of large windows. All your hot/cold air will then go right up your curtains instead of out into the room.

19. Include additional soundproofing between bedrooms and active areas. Also include more soundproofing if you plan to have wood or tile floors to reduce sound to the floor below.

20. Reconsider two-story or vaulted rooms. While these rooms are beautiful and spacious looking, many times they are also very loud and drafty. Additionally, they waste precious square footage that could be use for additional rooms.

21. Storage, storage, storage. Plan for more storage than you think you will need.

22. Plan space for guests. If you have many guests from out of town, consider a separate guest bedroom with a dedicated guest bathroom.

23. Include spindles and handrails that can be easily removed for ease in moving that huge king-sized bed.

24. Plan in pocket doors where ever you can. They save on space and are hard to incorporate later due to wiring, plumbing, and venting lines.

25. Work with your electrician and HVAC people to place vents, switches, and thermostats that make sense and are unobtrusive.

26. Consider heating with in-floor radiant heat. It keeps basements warm, requires far less energy, and provides a nice warm floor for you feet in the winter.

27. Take pictures of all the walls before Sheetrock goes up so you know where all the wiring, plumbing, venting lines are in case you needed to add or change anything.

28. Set up your appliances with both gas and electric should you choose to change them at a later date.

29. Provide a dedicated gas line to your grill.

30. Provide space to recess your refrigerator.

31. Make copies of manuals prior to installation and give the builder the copies so you can keep the originals.

32. Include a drain in your garage to get rid of the excess water from vehicles after it snows and so that you can wash your vehicle during inclement weather.

33. Place shut-off valves for your appliances in an easy access location. Place the water shut-off valve for your refrigerator under a cabinet. Place the shut-off valves for the washer and dryer above them, then enclose them in a cabinet.

34. Insulate under your basement floor.

35. Read up. Consider buying these books before planning your next home:

- How To Make Your House Do The Housework by Don Aslett

- Designing Your Dream Home by Susan Lang

- Better Houses, Better Living by Myron Ferguson

- The Not So Big House by Sarah Susan

As always, we'd love to hear from you. Please share any ideas you have. The more the merrier!